san antonio property tax rate 2021

San Antonio TX 78283-3966. For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers.

The Difference A Year Makes For Homeownership Home Ownership Home Buying Finding A House

Monday - Friday 745 am - 430 pm Central Time.

. See Property Records Tax Titles Owner Info More. As a property owner your most. Jessica Phelps San Antonio Express-News.

The citys current tax rate which accounts for about 22 of property tax bills is nearly 056. Projected Annual Rates of Change. 798721 Total debt levy.

Ad Premium Property Records. 39 rows 2021 Official Tax Rates Exemptions Name Code Tax Rate 100. Rates will vary and will be posted upon arrival.

The budget includes a tiny cut in. Bexar County commissioners approved a 178 billion budget for the 2020-2021 fiscal year on Tuesday. The Fiscal Year FY 2022 MO tax rate is.

Homeowners in neighborhoods such as. This budget will raise more total property taxes than last years budget by an amount of 20005658 which is a 312 percent increase from last years budget. Add Lines 22 and 23.

210 207-1337 SAN ANTONIO June 16 2022 Today the San Antonio City Council unanimously approved new. Secure Searches Payments. As required by section 102005 b of the Texas Local Government Code the City San Antonio is providing the following Statement on this cover page of its FY 2021 Proposed Budget.

48 rows San Antonio. Mailing Address The Citys PO. The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100.

City of San Antonio Property Taxes are billed and collected by the Bexar County. Bexar County collects on average 212 of a propertys assessed fair. Keeping in mind that San Antonios city property tax rate is 55 per hundred dollars eliminating this line item could be huge and it is in many areas.

Alternatively the city could exceed the revenue cap but doing so would trigger an. Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues increased by 31. Include property on which a tax abatement agreement has expired for 202119 24.

Collect only 9907 of its taxes in 2021. CURRENT PROPERTY TAX REVNEUE MAINTENANCE OPERATIONS. City of San Antonio Taxing Unit Name 100 West Houston St San Antonio Texas 78205.

Total adjustments to the 2021 taxable value. Be Your Own Property Detective. The citys revenues for 2022 is.

Adopted Tax Rate per 100 valuation General Operations MO 09502. The Commissioners Court also. Farm to MarketFlood Control Fund - Unencumbered Fund Balance The following estimated balances.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Box is strongly encouraged for all incoming. Total 2022 debt to be paid with property taxes and additional sales tax revenue.

Search Any Address 2. Maintenance Operations MO and Debt Service. Ad Find County Online Property Taxes Info From 2022.

PersonDepartment 100 W. Property Tax Rate The property tax rate for the City of San Antonio consists of two components. Search For Title Tax Pre-Foreclosure Info Today.

Find Comprehensive Property Tax Records in any State. San Antonio TX 78205. Search Anywhere On Any Device.

Jurors parking at the garage. Scott Ball San Antonio Report. When visiting downtown.

Get Record Information From 2022 About Any County Property. City of San Antonio Print Mail Center Attn. FY 20221FY 2023 FY 2024 FY 2025 FY 2026 30 30 35 35 35 Property.

14 2021 454 pm.

What Is A Homestead Exemption And How Does It Work Lendingtree

/https://static.texastribune.org/media/files/61547f1921b04a2c1250b7229511a4bb/2022Elections-constituional-lead-v1.png)

Property Taxes The Texas Tribune

Five Counties With The Lowest Property Taxes In Texas

Tarrant County Tx Property Tax Calculator Smartasset

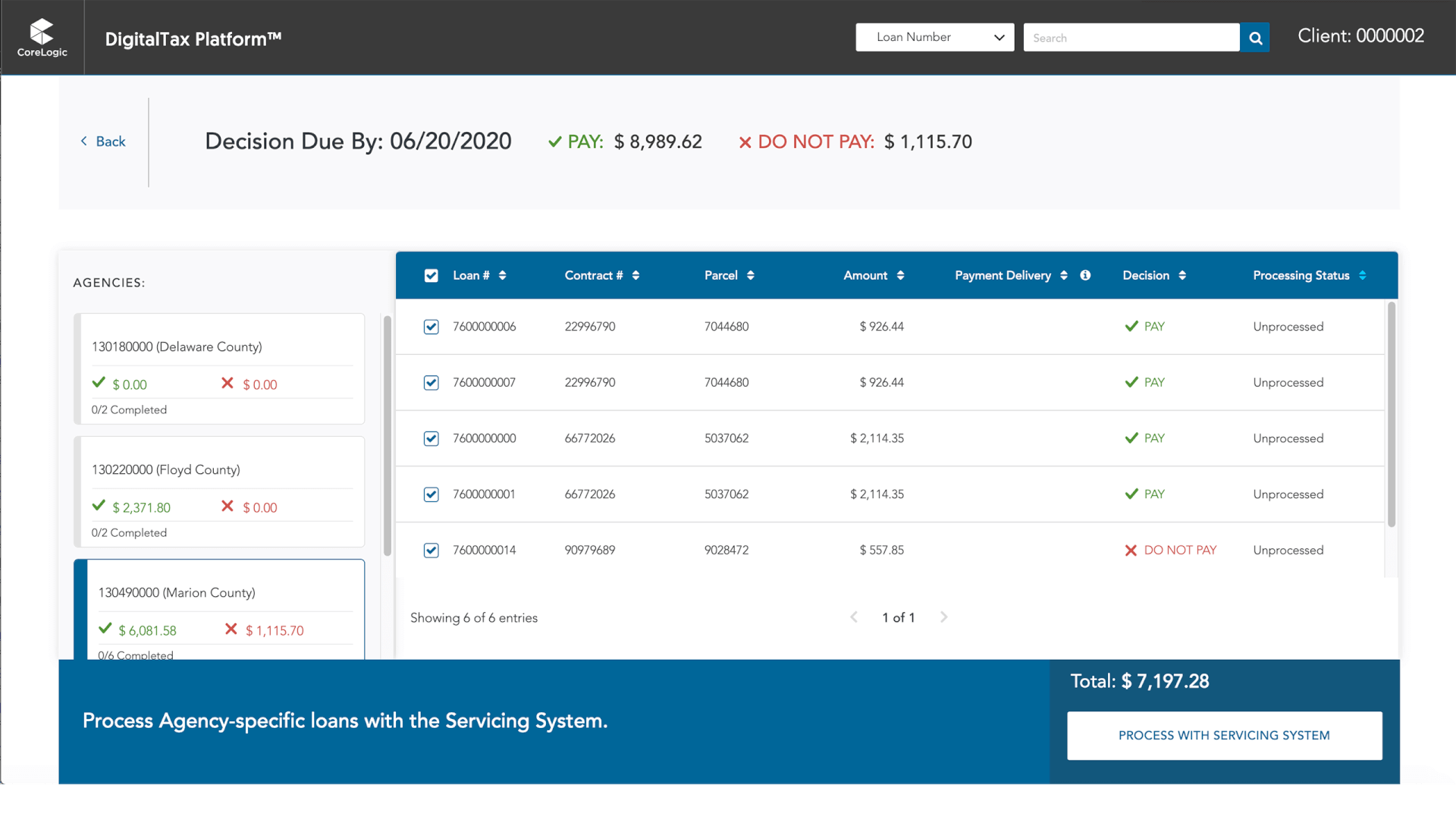

Residential Property Tax Solutions Corelogic

Tarrant County Tx Property Tax Calculator Smartasset

New Rules For Investment Property Cash Out Refinances Cash Out Refinance Rental Property Investment Property

Iltva Members Transfer Product Representation To Opei Inheritance Tax Estate Tax Military Retirement

Property Taxes By State Quicken Loans

Homestead Exemptions Here S What You Qualify For In Bexar County

Texas Property Tax Calculator Smartasset

Why It Makes Sense To Sell Your House This Holiday Season Selling Your House Sale House House Prices

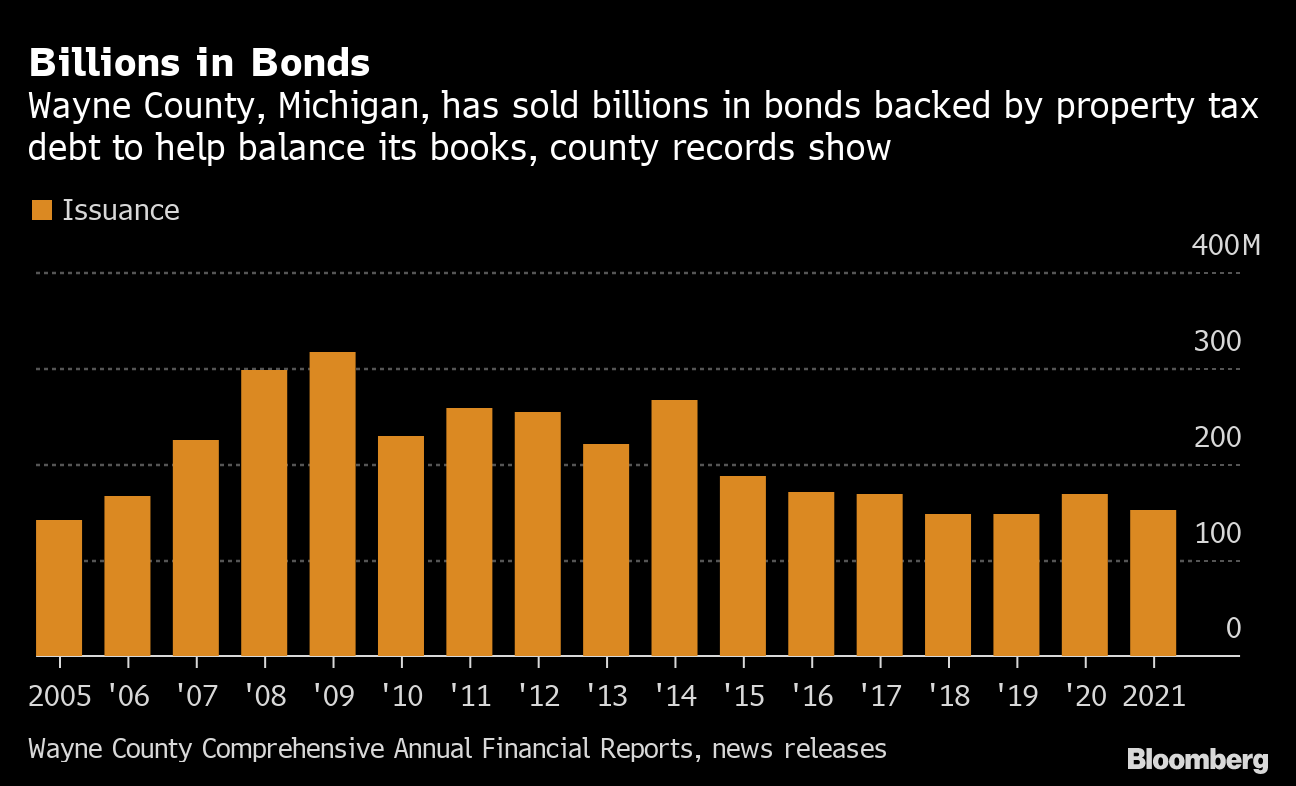

Property Tax Debt Scheme Minority Families Lose Homes To Money Machine Bloomberg

Some Struggling To Pay Property Taxes Turning To High Interest Lenders

The Hidden Costs Of Owning A Home

Texas Property Tax Calculator Smartasset

Bexar County S Homestead Exemption To Cut 15 Off Property Tax Bill

Real Estate Full Service Andy Tran Realtor Dre 01913079 Https Andytranhomes Com Htt Digital Marketing Online Business Commercial Real Estate