who pays sales tax when selling a car privately in california

On June 29 2020 California passed Assembly Bill AB 85 Stats. Submit all forms and report the transfer to Californias DMV.

Understanding California S Sales Tax

1450 is how much you would need to pay in sales tax for the vehicle regardless of if it was used purchased with.

. A Release of Liability form CA is usually. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Answer 1 of 4.

California Release of Liability. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. The seller of the vehicle has five days to report the transfer.

Who pays sales tax when selling a car privately in Texas. The sales tax rate for the sale of a vehicle is currently 725 plus applicable district taxes. Of this 125 percent goes to the applicable county government.

The DMV agent will register and log your vehicle transfer in the official records. Once youve sold your vehicle and provided all required documents to the buyer youll need to notify the CA Department of Motor Vehicles DMV that you no longer own the car. Of course you must follow the proper methods when selling a.

A record of the odometer mileage if the. For example if you decide to sell privately youll need to pay off your car loan to get the lien removed from the car title so that the title can be transferred to the buyer. For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply.

The minimum is 725. Toyota of Naperville says these county taxes are far less and tend to range from 025 - 075. But a car lien may affect the auto insurance coverage youre required to carry as well as the sales process if you decide to sell your car.

But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725. To calculate how much sales tax youll owe simply multiple the vehicles price by 006625.

Certificate of Title only. This is why it is easy to find a buyer in California. Multiply the vehicle price before trade-in or incentives by the sales tax fee.

In some states used car sales are sales tax free theory that sales tax collected when sold new not double taxing in other states there is no sales tax on a private car sale used but. Only if the seller has a Sellers Permit. One of the easiest ways to sell your vehicle in California is to sell it to a used car dealership.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. If the vehicles title has been lost stolen or damaged complete an Application for Replacement or Transfer of Title REG 227 form. On the other hand if you are making any profit out of this car you need to indicate it in your next years tax return as a capital gain.

Complete the online Notice of Transfer and Release of Liability within 10 days of the sale. Answer 1 of 9. You can often get much more than a trader would give you.

If possible you should consider a private sale as this can be a more lucrative option. In 2018 896007 personal cars were sold in California by multiple residents. That depends on the sate and the laws regarding sales tax.

But that tax is lower when you buy from a private party than when you buy from a dealer. Title transfer if registering the car as well. After reviewing all the paperwork and forms file them with your local California DMV office.

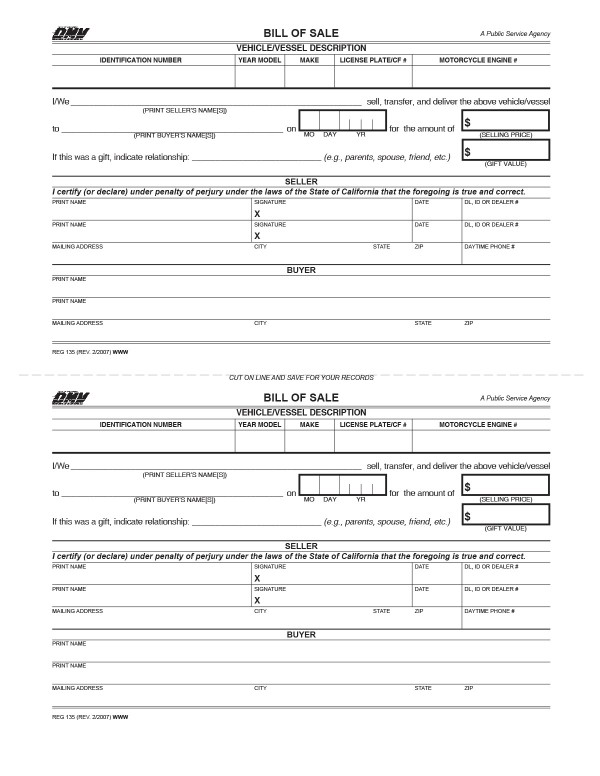

The buyer must pay all sale taxes. If the seller is not the owner whose name is on the title you will need a Bill of Sale signed by both the seller and the person whose name appears on the title. According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent.

How do I calculate sales tax on a car in California. If your vehicle is a business vehicle things get a little more complicated and usually taxes are related to the business taxes whether its gain or loss. This state also ranks first in terms of vehicle sales.

The major benefit of doing this is that they will walk you through all the paperwork and necessary steps. However the sales tax rate for gasoline is only 225 plus applicable district taxes. 8 and AB 82 Stats.

Beginning January 1 2021 certain used vehicle dealers are required to pay the applicable sales tax on their retail sales of vehicles directly to the Department of Motor Vehicles. Likewise who pays sales tax when selling a car privately in Illinois. If you buy a 1-year used model from a dealership for 14000 and the tax rate is 7 youll end up paying 980 in sales tax which is nearly 600 more than if you bought one through a private party.

The buyer will have to pay the sales tax when they get the car registered under their name. 106 Places for shopping. However you may not get the most money that you possibly could from the sale.

Selling Your Car to a Dealership. Cars bought from dealers are taxed at the basic 625 Illinois sales tax rate plus any local taxes. If the seller is not a Texas licensed dealer the purchaser is responsible for titling and registering the vehicle as well as paying the tax to the local county tax assessor-collector CTAC within 30 calendar days of the.

Buyers must pay a transfer tax when they buy a car. Motor vehicle sales tax is the purchasers responsibility. Thankfully the solution to this dilemma is pretty simple.

Otherwise the Buyer pays the Tax to the DMV when they change ownership and Register it. You do not need to pay sales tax when you are selling the vehicle. All fees must be paid within 30 days of the sale even if youre missing some paperwork.

20000 X 0725 1450. License plates regular 23 plus a 1 reflectorized license plate fee. Per the Daily Herald if you live inside the city of Chicago you will be charged an additional city sales tax of 125.

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Understanding California S Sales Tax

California Vehicle Sales Tax Fees Calculator

All About Bills Of Sale In California The Facts And Forms You Need

California Used Car Sales Tax Fees 2020 Everquote

How To Register Vehicles Purchased In Private Sales California Dmv

California Vehicle Sales Tax Fees Calculator

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

What S The Car Sales Tax In Each State Find The Best Car Price

Understanding California S Sales Tax

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Car Tax By State Usa Manual Car Sales Tax Calculator

Understanding California S Sales Tax

Trade In Sales Tax Savings Calculator Find The Best Car Price

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

Nj Car Sales Tax Everything You Need To Know

/buying-a-car-in-a-different-state-4148015-Final2-1a901895477c4c518d48407644568ce8.png)

Tips For Buying A Car In A Different State